Should I Hire A Property Management Company?

Deciding to hire a property manager can be a challenging process. Maybe you have heard horror stories about property management companies not doing their jobs. Perhaps you’ve self-managed your rental property for years, and now you are looking to retire and move to the Bahamas. Or maybe you’ve never managed before and aren’t sure what you should be looking for in a manager.

There are advantages and disadvantages to hiring a property manager, depending on what you are looking for. You may or may not have a basic understanding of Fair Housing laws, making it easier to manage on your own. Or you need to start generating revenue right away, and you just don’t know where to begin.

A good property management company can resolve a lot of the headaches that occur when you manage your property. However, we understand that it’s critical to have all the facts before deciding to hire a management company or to self-manage.

Here’s what you should consider when deciding if you should hire a property manager.

Click below to watch a video to get a summary of the blog:

Evaluating all aspects of a Rental Property from Owing to Renting It Out

Expense

The most prominent concern people have when determining if they want to hire a property manager is the cost of the service. Property management is a paid service, and initially, the cost can deter people that think they can do it themselves, especially if it’s just a single-family property or condo. But not so fast, you must have the same knowledge and management skills as if you were managing an apartment complex.

Most property management companies charge a monthly fee, which is typically a percentage of the month’s rent (standard rate is 7-10%). It’s important not to make your decision on the percentage but rather the dollar amount the company charges, and here is why. Most think a 2% difference in a management fee is a lot because we associate it with a Real Estate Commission when you sell a property. Yes, 2% commission difference on a $500,000 property is $10,000, but 2% difference on a $2000 rent is a mere $40 a month gross and after you write it off on your taxes (management fees are tax-deductible) would be about $24 a month or just 79 cents a day. To choose a company precisely because they offer a cheaper management fee that does not have the services, reputation, and longevity for 79 cents a day could be a big mistake. That’s a third of a cup of coffee at Starbucks, right?

On top of the monthly management fee, there might be a leasing fee. This fee goes toward the marketing of your property, i.e., listings, photos, video, and labor cost to get a property rented. These fees can run from $300 to $1000 or 25% to 100% of the first-month rent.

There might be miscellaneous fees as well, depending on the company. Some companies charge a markup on maintenance repairs, lease renewal fees, etc. and claim to have a low management fee but then charge extra fees on the side where other companies might not.

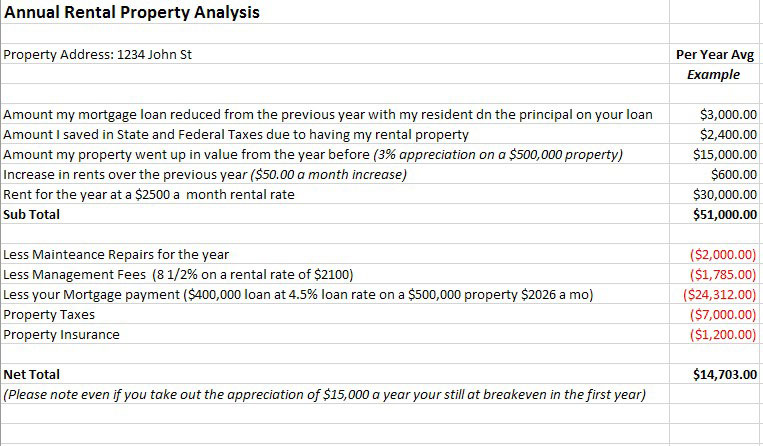

While property management is an expense, the benefits far outweigh the cost for most people. To see if you can afford it, you should evaluate all the costs. Most people only look at what their mortgage payment, taxes, and insurance are and what they can get in rent. If the rent covers all those items plus a management fee, then they assume they can afford it. But there is more to consider in the equation. An accurate assessment will include the amount your loan reduced, the amount you saved in taxes, and an increase in appreciation. See the illustration below.

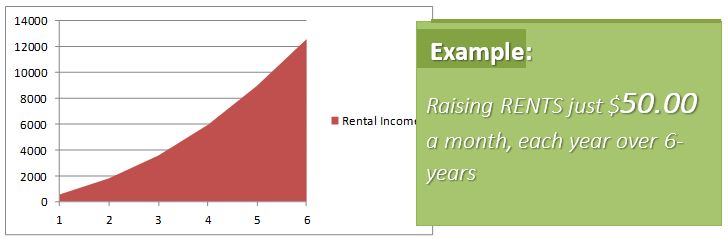

In the end, a good management company more than pays for itself by raising rents moderately. Whereas 95% of self-managing owners never raise rents, so in essence, if you don’t, you’re still paying a management fee (getting less rent is a management fee), and you still have to manage the property and have the headaches. Management Companies have proven residents don’t leave because you raise rents moderately (this would be like 2 -3% a year or $50 a month); they leave because of lousy service. The same reason you leave or quit going to a restaurant to eat because of horrible food or service. On the flip side, if that restaurant gives you excellent service, outstanding food and raises their prices 2-3% a year, you are more likely to keep going!

If you raise the rent $50 a month each year (that’s 2.5% on a $2000 rent) in 6 short years using this strategy, it will put $12,600 in your pocket, and this is not a typo it is $12,600 in 6 years. It’s like compounding interest, so the first year you get an additional $600, second-year $1200, third-year $1800, etc.

Experience in the Industry is more important than you might think.

A property management company that is worth their weight in gold should have years of experience managing properties. Management Companies that have been around a while should be familiar with Fair Housing Laws, been to court a time or two (it’s bound to happen), and hopefully has a defined process in place that allows them to provide you the level of service you deserve.

In the State of California, a property management company is required to have a Licensed Real Estate Broker overseeing the operations. This ensures the management company is held accountable to the Department of Real Estate and held to pretty high standards in terms of ethics and the way business is conducted. It also means that your company is well versed in Real Estate and should keep you out of legal trouble.

Over the years, chances are Management companies that have longevity in the industry, have experience handling late payments from residents, posting 3-day notices, security deposit disputes, residents that wish to break their lease, evictions, and more. These are things that can often be overwhelming for any landlord, especially if you have never managed a property before. Meaning you need to hold your resident accountable, and that means making sure they pay on time, and if not, they get a late fee, and then you need to collect it. Not doing anything sends the wrong signal, and now they are in control, not you — kind of like our kids. If you tell them to clean their room or they can’t go out, and you let them get by you lost all creditability. Be professional but firm to reach the short- and long-term results you want. Thankfully, property management companies have handled these issues and learned the best ways to combat them.

Lack of Involvement

Owners, at times, prefer to be involved in every decision that is made with their property. Such a scenario can be difficult if you choose to hire a property management company because most have systems in place that lean towards the hands-off approach.

Property managers likely won’t involve you for minor resident issues, maintenance issues typically under $300-$400 dollars, or other trivial matters. Usually, they are equipped to handle these issues efficiently, saving you time and money.

Property managers understand that your property is your baby, so to speak, and you want it taken care of. However, hovering over every move, they make only makes their job more difficult. If you are an owner that always needs to be hands-on, perhaps self-managing is a better fit for you; however, you will limit the number of properties you can own and still have a life.

Frees Up Your Time

Managing a rental property is time-consuming and frequently overwhelming. You are on call 24/7, so be prepared to have to leave your kid’s school play early to resolve a maintenance issue. Not only are you responsible for repairs at all hours of the day, but you are also the accounting department, leasing department, and legal department. It is a second job, or part-time, at best if you’re going to do it right.

Hiring a property management company to take on these tasks frees up a lot of your time. Taking care of the broken water heater or late rent payments will no longer be on your shoulders. You’ll be able to go about your life without the constant worry of being interrupted, especially when you’re on vacation.

You will be able to enjoy your life without being weighed down by resident disputes or meeting the plumber to replace the water heater. You can live with the reassurance that your property management company will take care of everything and only contact you for emergencies.

Maintenance Response Time Is Crucial to Long Term Residency

Over the last 30 plus years, we found the number one reason that residents move out of a rental property is due to a lack of maintenance. They don’t want the headache of one repair after another just as you don’t want the trouble when you take your car in for repair after repair. When repairs are not addressed timely and done correctly, residents get fed up and move on down the road, thus creating a vacancy for you to now fill.

Property management companies not only respond to maintenance issues quickly, but they typically have multiple licensed, bonded, and insured vendors that can tackle the job. Having resources like this saves you the hassle of having to research different vendors, getting bids, and then decide which one is the best fit. Not to mention, you don’t have to be at the property when the repair is completed.

A property management company likely has someone that is a dedicated maintenance coordinator or inspector that is experienced in handling maintenance and knows what things should cost and the kind of warranty you should get on materials and labor.